This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Web Income Tax Rate Table 2017 Malaysia masuzi October 19 2018.

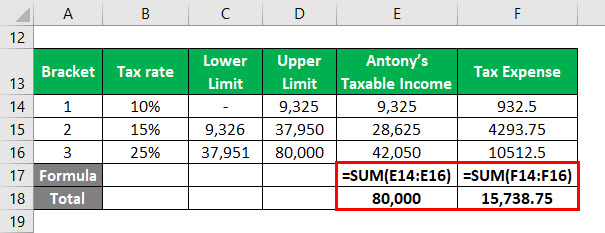

Effective Tax Rate Formula Calculator Excel Template

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil.

. Corporate tax rates for companies resident in Malaysia is 24. For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Mar 10 2022 In the calendar.

On the First 5000. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Masuzi December 15 2018 Uncategorized Leave a comment 1 Views.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News Income And. Tax Rate of Company. 2018 2019 Malaysian Tax Booklet Malaysia S 2018 Budget Salient Features Asean Business News.

Corporate Tax Rate in the United. Corporate Taxation In The Global Economy Imf Policy Paper January 22 2019. Year Assessment 2017 - 2018.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income. Rate the standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Buildings that are used with the sole purpose of approved business or expansion project as a BioNexus Company will get an.

A company that qualifies for group relief may surrender a maximum of 70 of its adjusted loss. Malaysia corporate income tax rate 2018 Corporate Tax Rate in the United States remained unchanged at 21 percent in 2021 from 21 percent in 2020. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Rate TaxRM A. Headquarters of Inland Revenue Board Of Malaysia. Companies incorporated in malaysia with paid-up capital of myr 25 million or.

Income Tax Malaysia 2018 Mypf My Malaysian Tax Issues For Expats Activpayroll. 20172018 Malaysian Tax Booklet. Corporate tax rates for companies resident in Malaysia is 24.

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible extension for. Free Online Malaysia Corporate Income Tax Calculator For Ya 2020.

Resident companies are taxed at the rate of 24. SST in Malaysia was introduced to replace GST in 2018. Company Tax Rate 2018 Malaysia Table.

The corporate tax rate for resident and non-resident corporations that include branches of foreign companies stands at. Web Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. An effective petroleum income tax rate of 25 applies on income from.

Why It Matters In Paying Taxes Doing Business. Tax Rate of Company. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

What is the Corporate Tax Rate in Malaysia. Audit tax accountancy in johor bahru comparing tax. Malaysia personal tax rate 2018 Deferred Tax Asset What It Is And How To Calculate And Use It With Examples Pin On Living In Malaysia.

The benchmark refers to the highest rate for Corporate Income. The standard Malaysia corporate tax rate is of.

Jaguar Land Rover Profit Before Tax 2011 2021 Statista

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Malaysia Tax Revenue 1980 2022 Ceic Data

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Effective Tax Rate Formula Calculator Excel Template

Income Tax Malaysia 2018 Mypf My

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Tax Due Dates Stock Exchange Due Date Tax

Individual And Corporate Tax Reform

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Who Owns The Wealth In Tax Havens

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Effective Tax Rate Formula Calculator Excel Template

Provision For Income Tax Definition Formula Calculation Examples